Stock Pitch Competition: Guidelines and Rubrics

Overview

The Stock Pitch Competition puts participants in the shoes of a Wall Street equity research analyst. Working with the same team from your high school for the rest of the competition, you will be tasked with analyzing one company and pitching a BUY, SELL, or HOLD recommendation on its stock. You will be given a list of companies on the day of the competition, from which you would choose one company to research on and write a max 2 page investment report. Investment reports will be judged primarily on the strength of the argument and the depth of research, as detailed in the rubrics.

Investment Report

While there is no strict guideline dictating the type of content the investment report should include, teams might find the following breakdown useful:

Each team is to submit one pdf document to [email protected] by the submission deadline (to be confirmed), with the document title <SCHOOL NAME>_<COMPANY>.pdf e.g. UCHICAGO_GOOG.pdf

The Stock Pitch Competition puts participants in the shoes of a Wall Street equity research analyst. Working with the same team from your high school for the rest of the competition, you will be tasked with analyzing one company and pitching a BUY, SELL, or HOLD recommendation on its stock. You will be given a list of companies on the day of the competition, from which you would choose one company to research on and write a max 2 page investment report. Investment reports will be judged primarily on the strength of the argument and the depth of research, as detailed in the rubrics.

Investment Report

While there is no strict guideline dictating the type of content the investment report should include, teams might find the following breakdown useful:

- Investment Overview: Recommendation and Price Target

- Company Background

- Industry Overview

- Thesis and Rationale

- Risks and Mitigations

- Catalysts

- Conclusion

- The first page of the document is to include the team name and team member names

- Expository text is to be written in at least 12pt Arial font, single-spaced

- The main investment report is to be maximum 2 pages in length (including diagrams and graphs)

- All sources must be referenced in a bibliography after the investment report (not included in the 2 page requirement). There is no specific MLA or Chicago formatting requirement as long as it is consistent

- The document is to be exported to pdf prior to submission

Each team is to submit one pdf document to [email protected] by the submission deadline (to be confirmed), with the document title <SCHOOL NAME>_<COMPANY>.pdf e.g. UCHICAGO_GOOG.pdf

FAQs

Do we have to use discounted cash flow analysis or comparable company analysis to formulate our thesis?

There is no requirement to build a valuation model using DCF or comps as part of the pitch. While some teams might find DCF or comps to be helpful in building a coherent argument, they are not necessary and teams would not receive bonus points for building a valuation model. Given the time constraint for the stock pitch competition, teams should consider the costs and benefits of dedicating too much time to create a valuation model, though the use of quantitative metrics to support arguments is highly encouraged.

Is there a word limit?

No. However, all teams must adhere to the document guidelines and keep in mind the presentation criteria in the rubrics.

How do we get started?

As the companies you will be researching on are generally well known, you can likely find analysis reports online (e.g. Seeking Alpha, Motley Fool). If you would like to access company financials you should turn to SEC filings, specifically the most recent 10Q and 10K. You can also check out the company’s investor relations page for recent news and developments regarding the company, investor presentations, and earnings calls to see what management and investors are most interested in.

Do we have to use discounted cash flow analysis or comparable company analysis to formulate our thesis?

There is no requirement to build a valuation model using DCF or comps as part of the pitch. While some teams might find DCF or comps to be helpful in building a coherent argument, they are not necessary and teams would not receive bonus points for building a valuation model. Given the time constraint for the stock pitch competition, teams should consider the costs and benefits of dedicating too much time to create a valuation model, though the use of quantitative metrics to support arguments is highly encouraged.

Is there a word limit?

No. However, all teams must adhere to the document guidelines and keep in mind the presentation criteria in the rubrics.

How do we get started?

As the companies you will be researching on are generally well known, you can likely find analysis reports online (e.g. Seeking Alpha, Motley Fool). If you would like to access company financials you should turn to SEC filings, specifically the most recent 10Q and 10K. You can also check out the company’s investor relations page for recent news and developments regarding the company, investor presentations, and earnings calls to see what management and investors are most interested in.

Rubrics

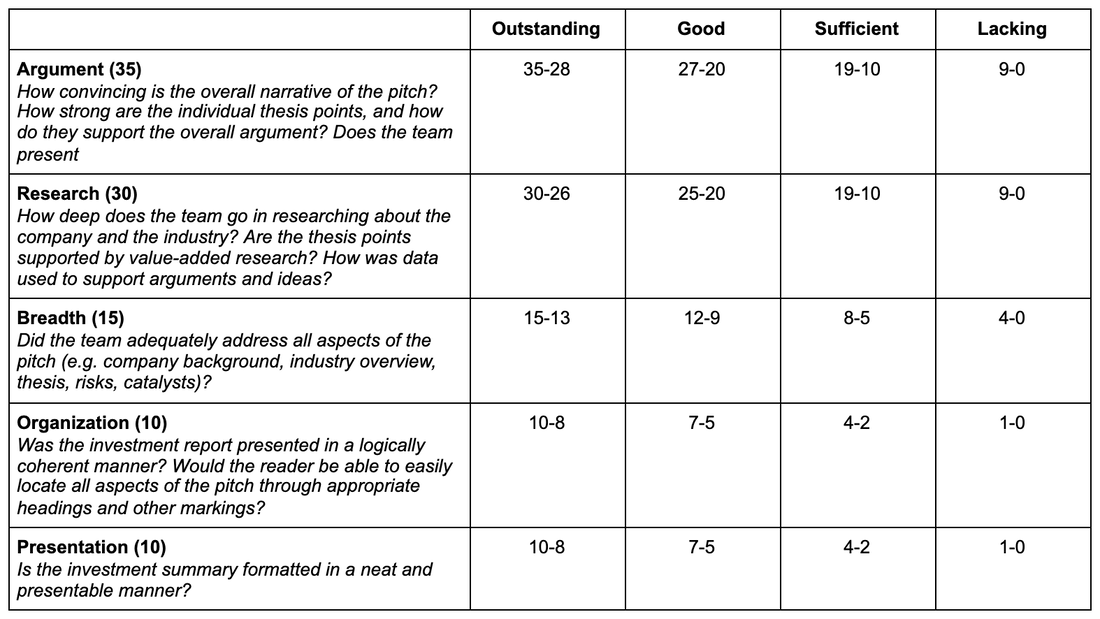

All stock pitches will be evaluated and scored using the following criteria and given a final score out of 100.

All stock pitches will be evaluated and scored using the following criteria and given a final score out of 100.

Sample Stock Pitch

Below in the pdf is a sample stock pitch that students can refer to in preparation. Please note we do not expect you to follow the same format as the sample document. Instead, please refer to the rubric for grading. The file is for students to see an example of what a stock pitch document could look like, but please be creative and adhere to the rubric instead. This document is also longer than students will be expected to write, however it provides good ideas for organization and how to divide up sections.

Below in the pdf is a sample stock pitch that students can refer to in preparation. Please note we do not expect you to follow the same format as the sample document. Instead, please refer to the rubric for grading. The file is for students to see an example of what a stock pitch document could look like, but please be creative and adhere to the rubric instead. This document is also longer than students will be expected to write, however it provides good ideas for organization and how to divide up sections.

| sample-stock-pitch-v1.pdf | |

| File Size: | 263 kb |

| File Type: | |

Contact [email protected] with any questions